What is the difference between HMO, PPO, HDHP, POS, EPO?

Which health insurance plan is best for you?

The answer to that question depends on multiple factors that pertain to your specific situation. When comparing health plan options, take these factors into account:

- Your health

- Your family’s health

- Your health care providers and whether they accept the insurance

- Your financial situation

- Whether you want to pay more upfront via premiums, but more in out-of-pocket costs when you use health care services -- or vice-versa

- If you want a larger provider network

- If you don't want to get referrals to see a specialist

Once you review those factors, choosing a health plan is much easier.

The five most common types of health insurance plans are:

- Preferred provider organizations (PPOs)

- Health maintenance organizations (HMOs)

- High deductible health plans (HDHPs)

- Point of service plans (POS)

- Exclusive provider organization plans (EPO)

PPOs are the most common type of health plan in the employer-sponsored health insurance market, while HMOs lead the way in the individual insurance market. HDHPs make up about one-third of employer-sponsored plans and are seen as a lower-cost health insurance option for employers over the past decade. POS and EPO plans are options, but they’re not as common as HMOs, PPOs and HDHPs.

In this guide, we provide information about each of these plans to help you make the right decision for your circumstances. We will go through each of the five plan types and highlight the differences:

- What is a PPO?

- What is an HMO?

- What is an HDHP?

- What is a POS?

- What is an EPO?

- What is the difference between HMO, PPO, HDHP, POS and EPO?

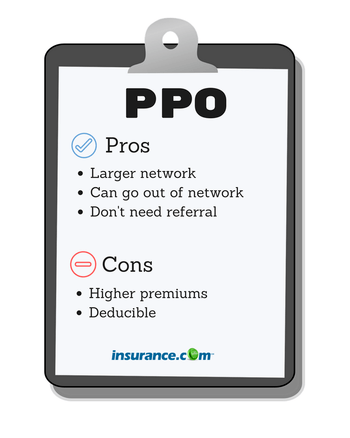

What is a PPO?

PPO stands for preferred-provider organization. A PPO's premiums are usually much higher than an HMO and HDHP, but that comes with greater flexibility.

Forty-seven percent of enrollees in employer-based health plans are in a PPO. PPOs are also fairly rare in the individual market. Only 16% of individual plans are PPOs.

You usually don’t have to select a primary care provider (PCP) in a PPO plan. A PPO often has larger healthcare provider options than an HMO. PPOs allow you to get both in-network and out-of-network care -- though out-of-network providers cost more. You can also see a specialist without a referral.

Though a PPO gives you more independence, this doesn’t mean that you have complete access to the health care system without any oversight. A health plan may still require you and a physician to get approval for a costly service, such as an MRI. That's called a prior authorization, which has become common in health care.

Kaiser Family Foundation reports the average annual deductible for a PPO single coverage plan is $1,204. Once you reach your deductible, your insurer begins to pick up its portion of the coinsurance.

The plans also include an out-of-pocket maximum for in-network care. If you reach your out-of-pocket maximum, your insurer covers all costs. A plan’s out-of-pocket maximum can vary widely, so you’ll need to check to see the out-of-pocket maximum for your plan.

The main benefit of a PPO is flexibility, but it comes at the cost of higher premiums and a deductible that you will have to pay before your insurer starts paying for care.

When a PPO might be right for you:

- You want the flexibility to go out of network and not need to get referrals.

- Flexibility is more important to you than paying higher premiums.

- You would rather pay higher premiums with potentially lower out-of-pocket costs when you need care.

What kind of person should opt for a PPO: Someone who utilizes health care regularly and sees specialists or wants to have the option to see a specialist without getting a referral.

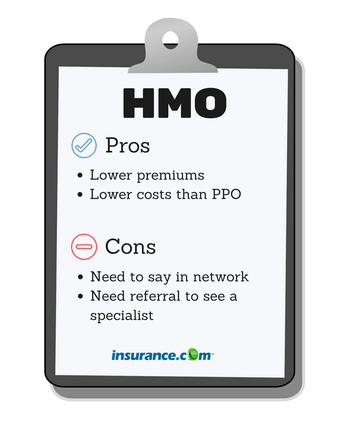

What is an HMO?

HMO stands for health maintenance organization and makes up 13% of employer health plans, but about half of marketplace plans. It's known for lower premiums than PPOs and a restricted network of doctors and hospitals. That smaller network means you sacrifice flexibility for lower costs.

You’ll likely pay much less in premiums for an HMO compared to a PPO.

You’ll likely pay much less in premiums for an HMO compared to a PPO.

HMOs require that you name a PCP who “coordinates” care. Your primary doctor must refer you first in order to see a specialist. HMOs may have a deductible, but it's lower than other plans. The average deductible for individual coverage is $1,201. Health plans have been increasing HMO deductibles at a faster rate than other plans in recent years.

One drawback to an HMO is that these plans usually don’t allow you to go outside your network. If you do, you pay for the care on your own. An exception is if you need emergency care, which requires the facility (but not necessarily the providers) to bill as in-network.

Not all providers accept HMOs. Before choosing an HMO, make sure your provider or providers take the plan.

When an HMO might be right for you:

- You have a primary care physician and other providers who are in the HMO network.

- You don’t see many specialists and don’t need referrals often.

- You don’t mind the limitations of only seeing providers in your network.

- Lower premiums are more important to you than flexibility.

What kind of person should opt for a HMO: Someone who wants to pay as little as possible in premiums though not have to face high deductibles. An HMO could be a good option if you have a PCP and your other health care providers are already in the HMO.

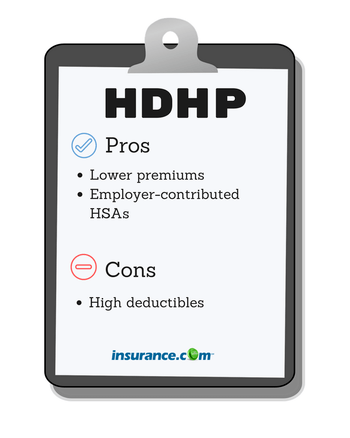

What is an HDHP?

HDHP stands for high-deductible health plan. HDHPs have grown in popularity as more employers offer the plans as a way to contain health care costs.

Thirty-one percent of workers have a HDHP. HDHP plans in the marketplace are called Bronze or Silver plans. Seventy-six percent of people with a marketplace plan has either a Bronze or Silver plan.

An HDHP describes only the deductible and out-of-pocket costs. An HDHP can have a PPO or HMO benefit design. What's makes an HDHP a high deductible plan is its hefty deductible.

The IRS defines an HDHP as a health plan with a deductible of at least $1,400 for an individual and $2,800 for a family. You need to pay that amount for care before your health insurance chips in.

The average HDHP deductible is $2,303, but many plans exceed $3,000, according to the Kaiser Family Foundation.

An HDHP's out-of-pocket in-network costs can't exceed more than $7,000 for an individual and $14,00 for a family.

You’ll want to keep that in mind if you choose this plan, and you should set aside money for the deductible in case you need it.

Once you reach the deductible, your insurer will begin to pay its share and you'll pay your percentage of coinsurance. Your insurer will cover all costs once you’ve hit your out-of-pocket maximum.

HDHP usually have lower premiums, so they can be a less costly plan option -- as long as you don’t need a lot of medical care. HDHPs might be a good idea if you are young and healthy, but could be costly to older adults or young families.

Another feature that might interest you is that HDHPs typically feature a Health Savings Account. An HSA allows you to save money pre-tax to pay for qualified medical expenses. Some employers seed money in employee HSA accounts to help pay for care, so you’ll want to see if your employer provides money to employee HSAs when making a health plan decision.

Before deciding on an HDHP, think about your next year of potential health care costs to see whether the lower premiums will more than offset the potential costs of care.

When a HDHP might be right for you:

- You don’t have many health care costs and you don’t expect to have many costs over the next year.

- You’d rather pay fewer upfront costs in premiums with the understanding that the higher deductible means you’ll pay more out-of-pocket if you need care.

- You don’t have children and/or a spouse on your plan who may use a lot of health care services.

What kind of person should opt for a HDHP: Someone who is healthy and doesn’t expect to use many health care services within the next year. You want the cheapest premiums and don’t mind having to pay a high deductible if you need care.

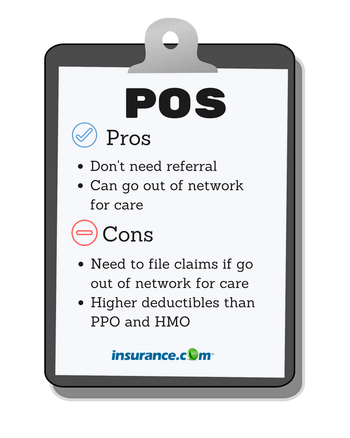

What is a POS?

POS stands for point of service plan and makes up only 9% of health plans. POS plans are a hybrid of PPO and HMOs. In fact, point of service means that the health care consumer gets to choose whether to use HMO or PPO services each time you see a provider.

POS plans usually have similar rules to HMOs. For instance, you need to choose an in-network physician as your PCP. However, you can see an out-of-network physician for a higher fee in a POS plan.

When a POS might be right for you:

- You have a PCP in the POS plan.

- You want the flexibility of going out of network like a PPO -- and don’t mind paying the higher out-of-pocket fees when you need to go out of network.

- You’re good at keeping health care receipts. You don’t mind filling out forms and sending in bills for payment if you get care out of network.

What kind of person should opt for a POS: Someone who likes being able to go out of network for care, but also wants a PCP coordinating your care.

What is an EPO?

EPO stands for exclusive provider organization and is a managed care plan that requires you to go to doctors and hospitals in the plan’s network.

You don’t need to choose a PCP or need a referral, so in that sense, it’s similar to a PPO, but you will only receive coverage for providers in your network. Other parts of an EPO plan are similar to an HMO, such as having a limited network of doctors and hospitals. You can’t get care outside the network unless it’s an emergency.

You don’t need to choose a PCP or need a referral, so in that sense, it’s similar to a PPO, but you will only receive coverage for providers in your network. Other parts of an EPO plan are similar to an HMO, such as having a limited network of doctors and hospitals. You can’t get care outside the network unless it’s an emergency.

Much like a PPO, you need to get approval from your health plan in order to get what’s deemed as an expensive service.

When an EPO might be right for you:

- You want the flexibility of a PPO and don’t need a referral as long as you stay in network.

- You’re OK having a limited network of doctors and facilities like an HMO.

- You want a network like an HMO, but don’t want to choose a PCP.

What kind of person should opt for an EPO: Someone who doesn’t mind have a limited number of doctors and facilities and would rather not have to get a referral to see a specialist.

What is the difference between HMO, PPO, HDHP, POS and EPO?

It’s open enrollment season at your job and your employer offers you a choice between the three biggest plan types: HMO, PPO and HDHP. Which is best? It really depends on your financial and medical situation – and preferences.

For instance, would you rather the flexibility of not having to go to a smaller group of providers in an HMO and don’t mind paying more upfront for your care via premiums? Then, a PPO might be right for you.

Do you not care about having a large network of providers, but want to make sure you pay as little as possible for health care? Then, an HMO could be perfect.

Do you not use medical services often and you want a plan that protects you, but not cost much in terms of upfront premiums? Then, a HDHP could be the direction to go.

Choosing the right health insurance plan is a personal decision and depends on your situation and preferences. Whether you ultimately choose a PPO, HMO, HDHP, POS or EPO, take costs, flexibility, coverage and convenience into account when making that decision.

Here's the average premium and deductible for single coverage for each plan as well as how the plans differ in terms of referrals and out-of-network care:

| Type of plan | Average premium | Average deductible | Need referrals? | Out of network care |

|---|---|---|---|---|

| HMO | $1,212 | $1,201 | Yes | No |

| PPO | $1,335 | $1,204 | No | Yes, but costlier |

| HDHP | $1,061 | $2,303 | Varies | Varies |

| POS | $1,419 | $1,714 | No | Yes, but costlier |

| EPO | NA | NA | No | No |

Kaiser Family Foundation, 2020 Employer Health Benefits Survey. Note: The survey did not include the average premium or deductible amounts for an EPO.